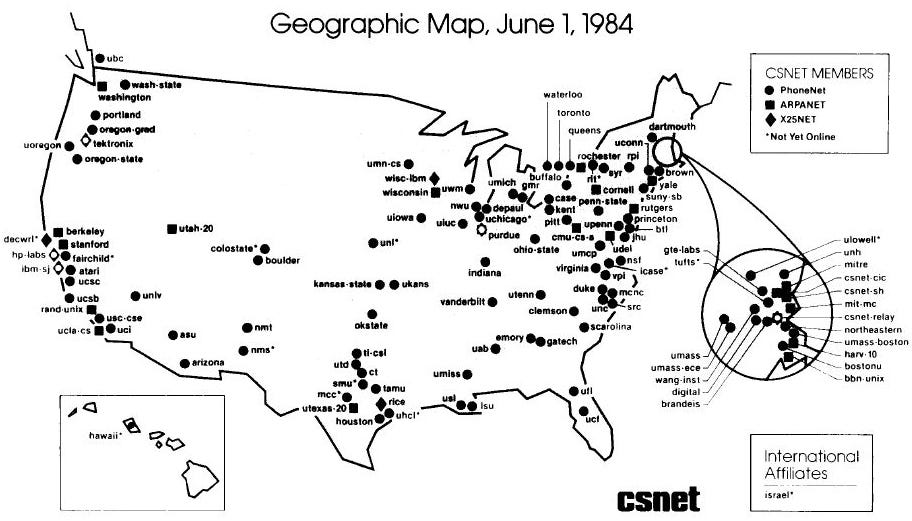

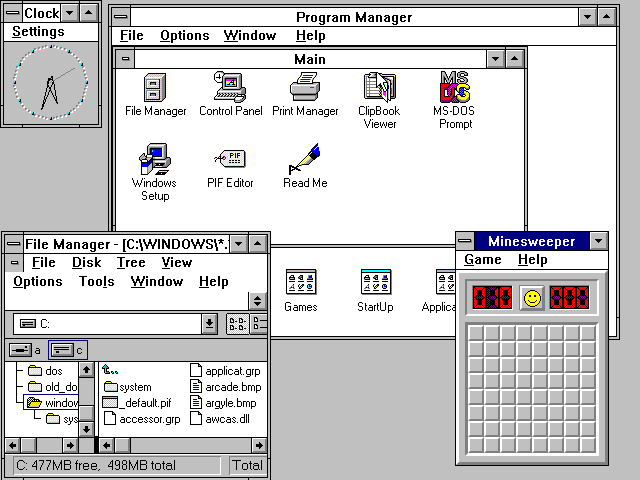

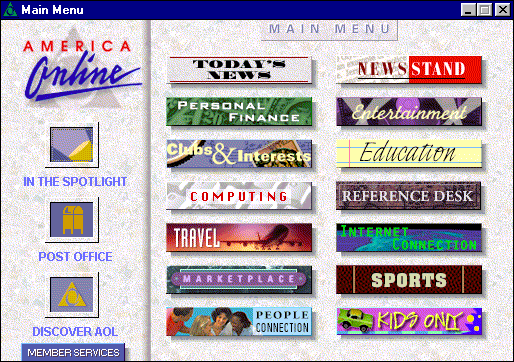

Those who know me are aware that I have a penchant for exploring emerging technologies. I grew up as an early user of the consumer internet, getting online for the first time in 1991. I was a relatively early adopter of cryptocurrency in 2013. And recently, I have become transfixed by AI and what it means for society. Coupled with my 15 years of experience as a management and change consultant, with experience advising nearly 100 different organizations, I believe this gives me some perspective which may be helpful for the conversation which we are about to start as a society around AI and how it will affect the way we live and work.

Over the past few weeks, I've been deep in a practical and intellectual rabbit hole on consumer AI (artificial intelligence), and I am both amazed and alarmed by what I've experienced. I felt compelled to share my findings and thoughts with you at this juncture.

I believe this is the most important technology developed since the internet / world wide web, and I believe we will look back on the release of OpenAI's ChatGPT-4 as a watershed moment in human history. In many ways, the emergence of this technology will be even more powerful and disruptive than what we saw with the rise of the Internet, because now the Internet will globally accelerate the AI adoption still to come. Over the past 30 years, AI is something which loomed in the far-off distance- something which would arrive "someday." I am here to tell you that "someday" was actually "yesterday." AI technology will profoundly impact the way you work, and it will likely happen much faster than you think.

A New Era of Consumer AI

In recent decades, we have seen all kinds of publicity stunts where AI defeated top Chess and Go masters, and while these were significant achievements, the kind of "general-purpose" artificial intelligence which anyone could use for almost any purpose simply didn't publicly exist.

Enter ChatGPT, powered by GPT-3.5 which launched in November 2022. One of the most important aspects of this launch is anyone could sign up with an account to utilize this "chatbot" on a free basis. The product was revolutionary in many ways, allowing users to interact with the GPT-3.5 LLM (large language model) in a way which mimicked human speech interaction. You could simply chat with the chatbot as though it were a person, and it would respond to you. It could recall a massive number of facts included in its dataset, arrange them into coherent responses, and perform basic reasoning- all in easily readable English sentences. While it was not perfect, it was the first time many users knowingly interacted with an AI for entertainment and productivity purposes. The product was a huge success, with over 100 million users signing up to use it shortly after its launch- the fastest growth of any product in human history.

Users delighted in asking ChatGPT to recite key facts and solve problems, but as an LLM, the model suffers certain limitations. For example, it's not particularly good at doing simple math problems and will often get them wrong. But can you ask it to write you a poem with 26 words with each word beginning with the next sequential letter of the alphabet? Yes, no problem. The way these models work is something akin to how a human brain works as a neural network. When you are speaking, you don't always know what the rest of your sentence will be as you utter you first word, but you have an idea of what you intend to say.

While AI technology has been used behind the scenes by firms like Google for ad-targeting and personal assistant voice recognition, having such functionality in a consumer-facing chatbot was groundbreaking. Microsoft, a significant investor in OpenAI (10% stake) moved quickly to integrate it into their products, including their browser (Microsoft Edge), their search engine (Bing), and Microsoft Office in the form of a new, AI-powered "Copilot." Google was forced to respond quickly, and by most assessments, sloppily, with its own "Bard" chatbot assistant. Google ostensibly invested in AI capabilities for decades but failed to foresee an upstart competitor like OpenAI/ChatGPT launching with an open, free-to-use basic capability model which consumers could interact with directly (and this has BIG implications for a firm like Google and its business model, as I'll discuss later in this article).

Defining everything these models can do is beyond the scope of this article, but there are many YouTube videos and articles which explore this. But most importantly, I encourage to you to sign up for an account and try it out yourself. Not just for a few moments, but over the course of at least two weeks, seeing how you can utilize it for your work (a free account gets you limited access to GPT-3.5, and a $20 per month gets you access to the substantially more advanced GPT-4).

GPT-4: From the Future

I was an early user of GPT-3.5 when it launched, and I was impressed but saw many limitations and not enough applicability to most "real world" work. But with GPT-4, everything changed.

GPT-4 launched on March 14, 2023, though to little fanfare (unless you deeply follow AI). By then, many of the people who had tried GPT-3.5 in late 2022 hadn't used it for a while. Some saw GPT-3.5 as a useful tool, but many viewed it as a novelty. But GPT-4 is a new beast, reportedly developed and trained with heavy input from Microsoft engineers, and it completely changes the game.

GPT-4 as a model, despite launching less than half a year after GPT-3.5, feels like a 10x improvement in capability over GPT-3.5. And in many areas, we are looking at a 0-to-1 moment. I will not detail everything which makes it different from GPT-3.5, but some highlights:

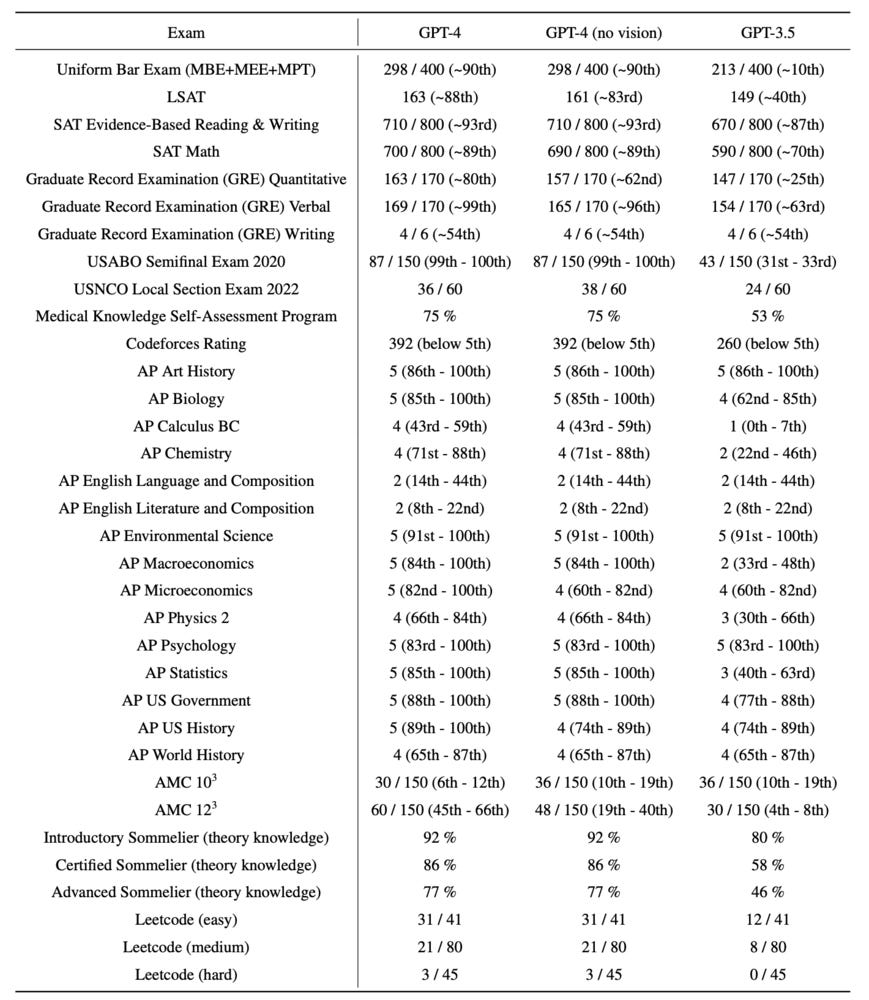

Routinely solves highly complex problems and has surpassed previous performance on academic and industry tests, to the point where it is now capable of earning a top 10% score on the bar exam

Understands context at a very advanced level, capable of comprehending many real-world scenarios which you describe to it. You can describe a situation or scenario and GPT-4 will effectively "render it" completely in its own "mind," allowing you to then manipulate objects and parameters within that scenario, with GPT-4 taking note of those changes and able to deduce associated consequences of any changes. It can make associations between disparate topics and subject matter effortlessly

In my experience and that of many others, GPT-4 is now the best interactive tutor and knowledge repository ever created. Users can ask it nearly any question based on "textbook-grade" knowledge, and then drill up, down, and across with follow-up questions. It is the single most useful educational tool I've ever encountered in my life, and it will revolutionize education

Effortlessly completes simple and many complex coding tasks within seconds. Users can now provide a prompt which describes the logic of a program and GPT-4 will provide code which executes that logic in any programming language

I've included a table below from the GPT-4 Technical Report which illustrates just how capable GPT-4 is in several standardized tests compared to the previous GPT-3.5 model.

In saying all of this, the technology is not perfect, but I will suggest to you that it does not need to be in order to profoundly change the nature of work and society. For example, it is still not particularly good at doing math (because as a language database, it may use language tools to incorrectly solve math problems). It will sometimes "hallucinate," believing incorrect things, either in response to its training process or to false information you may provide within a chat. But often, what you ask it to do, it can do very well. Even if it is only good to an 80% level for many tasks, that is still a substantial boost to human productivity, logically allowing one employee to potentially do the work it may have taken 5 to do in the past.

But the ChatGPT chatbot is not the end of the story. OpenAI also provided API (Application Programming Interface) access to GPT-4. This means that for a per-query fee, third party developers can use GPT-4 to process whatever logic they'd like. One of the profound and less obvious consequences of this is that I believe traditional apps as we know them will mostly be dead in 10 years. Many apps will evolve into protocol layers which are just networks of users and economic activity, called upon by user-facing AIs which serve as personal assistants and create highly customized logic tailored to you, serving as a gate-keeper for a tremendous amount of your online activity. Apps which don't do this proactively run a high risk of being disrupted by those who do. Absolutely no one will want to deal with the hassle of opening up an app to do a routine task (like calling an Uber, ordering food, turning on smart lights, etc.) in several years. They will want to work with their AI assistant to make things happen for them, in many cases without even asking.

Many of these functionalities may be here before you know it with ChatGPT Plugins. Plugins allow those developers to ask ChatGPT to use data from the open Internet as a part of their app logic. This means that instead of searching for 5 different flights and hotels on Expedia and then make a series of restaurant reservations on OpenTable, you can simply give ChatGPT a query like:

"ChatGPT, I want to go to New York next week. Check my calendar for when my last meeting is on Monday, then book my travel to New York. I want to stay near my favorite restaurant in Times Square. Please get me a reservation there on either Tuesday or Wednesday. Book return travel back on Friday or Saturday (whichever is cheaper). Let's make that leg of the journey first class. Oh, and have groceries delivered and ready for me when I arrive back home."

Though it is very early in this race, to say Google is now put in the position of playing catch-up would be an understatement. Some now speculate that the company had developed many of these technologies before but kept them locked away for fear of societal consequences and potential harm to their ad-search businesses. While I don't think AI is capable of replacing search just yet, I already know several people who now ask their questions to AI first, and all it took was one week of using ChatGPT to reach that point. The Google search field you type your queries into is vital for their business, and it is the interaction point for almost all of their user-served ads. Coupled with the launch of AI-powered Bing Chat into Microsoft Edge, it is clear that Microsoft is in fact going to "make Google dance," as Microsoft CEO Satya Nadella proclaimed.

And when we consider the possible end of traditional apps and the rise of open APIs, there are other consequences which I believe will impact technologies like blockchain-based cryptocurrency, where bank accounts are not required for instant settlement of economic activity. This could be inevitable as many of these APIs become global in nature and the realities of settling fiat currency still induces significant lag into economic activity (manifest in everyday activities like bank transfers). Smart contract-powered apps on public blockchains like Ethereum are effectively permissionless APIs themselves.

What does AI mean for the future of work?

I am not being hyperbolic when I say that I believe the Information Age ended on March 14, 2023 with the launch of GPT-4, and we are now entering a new era which will be known as either the "AI/Robotics Age," the "Knowledge Age," or the "Machine Age." I believe AI will profoundly change the way we work, and the time to pay attention to it is now. Earlier this week, several prominent public and business leaders, many of them senior in the field of AI, signed an open letter calling for a 6 month moratorium on the further development of AI technologies more advanced than GPT-4. This was in response to what they see as massive potential disruption to the global workforce, information platforms (which are already starting to be infiltrated by AI bots), and a lack of time to prepare society for what is coming. It's worth noting that some researchers have articulated even more existential concerns, worried about our eventual progression into a Artificial General Intelligence, where future AIs may have intelligence and capabilities far beyond what humans are capable of or even understand and use it to eventually destroy humanity.

I will not list all of the occupations which I believe will be impacted by AI. Frankly, it would be too long and my goal in writing this is not to call out any specific profession. I've already shared the example of what is happening to programmers, but know that these dynamics will extend far beyond that. Few people want to think of their own hard work and analysis as something which could be automated by AI, so instead, ask yourself: how much of your own work is sending an e-mail or a chat message to someone else, asking them to do something for you or to provide you with some piece of information? Now consider, how much of their work could be done by an AI, trained on your organization's internal data and knowledge from reputable sites on the Internet, with the ability to engage socially and economically on your behalf on the Internet? Probably a lot more than most might think.

To be blunt, the concerns around massive disruption of the global workforce in the near-term are real and founded. Historically, so called "knowledge workers," who had advanced skills like coding or legal expertise had substantial moats to their work. They were more immune to the relentless focus American industry put on outsourcing, off-shoring, and automation since the 1980s. But the tables have turned and it is knowledge work which AI will most effectively augment, and in some cases replace. Now, at least some of that knowledge work are the very first tasks AI / GPT-4 is good at. Not just sort of good, scarily good; to the point where it can do something like 80% to 90% of coding tasks in a matter of seconds- tasks which might take some humans hours or days. Especially in the discipline of coding, almost every elite coder I know working on cutting edge technologies like blockchain is already using AI tools to accelerate their work, and many claim to be more than 10x+ productive as a result. This means that individual coders can do more than ever before, which either means we will have more coding than ever before, or fewer coders than before.

But it is not all doom and gloom- there are perhaps reasons to be optimistic. In the history of technological disruption, humans always found creative ways to use new tools to make their work better and do even more of it. It has been a fundamental reality in our civilization's ceaseless increases in productivity, which have gone exponential since the dawn of the Industrial Age (since ~1760) and more recently during the Information Age (since ~1970). There is good reason to believe that we can and will use these technologies simply to be more productive at scale, rather than totally replace human jobs. Workforce reskilling can be impactful, and if the displaced workers this time really are among some of our brightest, then perhaps they will be even more enterprising in finding or creating new opportunities for themselves.

But I think we must consider the fact that demand for new work may not increase on pace with how quickly the technology could replace humans doing similar work today. If in fact 80% of coding work can be automated, then it is not likely that we will immediately find 5x the amount of coding work to meet current employment in this field. Potentially even worse within the context of this scenario, this is the worst the AI will ever be at these tasks. From here, it will only get better and with many more well-heeled firms participating in its development.

Further, if we experience possible recessionary conditions in the economy in late 2023, firms will have "the cover" they need to eliminate jobs at scale. Many will replace certain roles with AI or AI-augmented workers, and they will never backfill the employees they laid off. Meanwhile, new firms entering the market will never scale up their workforces in the same way as legacy firms- conditions which we know from history could lead to large-scale corporate disruptions from scrappy upstarts who are able to stay forever lean.

I believe we need intelligent government policies to deal with the disruption I expect we will see over the next 5 years (mostly as subsidies for displaced workers and reskilling programs, and perhaps in the form of new corporate taxes or subsidies for employing humans), but there is no putting the genie back in the bottle. While the "open letter" I mentioned earlier in this article may have good intentions behind it, the game theory suggests that no government would ever agree to a 6 month pause on AI research in earnest, and that many governments and firms would violate it in secret if they did.

We are in a new era, and AI is the new global arms race. Think one part Manhattan Project and one part Space Race / Moon Landing. And if we consider the Space Race as our example, then GPT-4 is our "Sputnik" moment. The stakes are enormous for both governments AND firms to figure out how to put this technology to good use, and quickly. Any society which attempts to limit the use of AI in material ways may find themselves on the wrong side of history as they are quickly left behind in both immediate productivity and future AI technology advances. AI will massively increase human productivity and will create untold wealth for our societies, especially when it is eventually paired with robotics. And from this point, it will accelerate all of our civilization's research efforts such that we advance faster and faster. There is no stopping what has started here, and indeed I expect to see AI budgets increase on the order of 10x to 1000x in many organizations.

What can you do to prepare for it?

Be receptive, be curious, be ahead of the curve, and learn to think like an executive.

As a former change consultant, I can say with confidence that the people who most resist a change, be it in a workplace or in society, are often the ones who will lose the most from it. The time to be flexible and curious is now. You must take the time to experiment with and learn how these technologies work. The state of play in AI is likely to rapidly change over the next few years, but that is no reason to be complacent. Whether you are a senior leader or a rank-and-file employee, you can likely make use of this technology today, and your ability to use it for more and more tasks will only increase in the coming years.

And if you don't use it, or if you don't encourage your employees to use it, you will soon notice that there are some employees who are "magically" doing more work than their colleagues. You may think they are superhuman, but it is more likely that they are quietly using AI to accelerate their tasks. And the incentive to do so only increases if we do face recessionary conditions where employees may seek every employment advantage they can get to avoid being laid off. I've already heard from tech-savvy folks who make hiring decisions at technology companies and law firms who now tell me that "experience using AI" will be a make-or-break hiring decision for them moving forward.

And my final and most important advice: learn to think like an executive. In an AI world, information is commoditized, analysis is commoditized, and indeed "doing" is commoditized. You must learn to become comfortable with giving orders (i.e., "prompts") to the machine to do your work for you. I suspect that within a few years, we could be at a point where a single prompt could generate and maintain the infrastructure to operate entire businesses or business lines. This means you can spend more time coming up with the "big ideas" which will move your organization forward.

And the ultimate hope is maybe, just maybe, this is the technology revolution which gives us all some time back (finally!). The minutiae of our jobs are effortlessly automated. We can all focus on the big picture and spend less time doing it. Unlike e-mail and smart phones, perhaps AI doesn't mean we have to work from everywhere all of the time. It just means we need to work in a way which focuses on making good, impactful decisions and achieving results more than ever. Perhaps something to be optimistic about in all of this.